Lunar invests in technical founders taking science risk to build world-changing companies. Stop me if you think you’ve heard this one before. lawrence@lunar.vc.

Atomic energy yes? I raise your fission and small modular reactors (SMRs) with fusion? If the timelines for SMRs to power datacentres were mismatched, you just wait…

I’ve been on somewhat of a “journey” with fusion. I wrote a few years ago:

“Best case scenarios from private companies are “within a decade”. But these timelines are at odds with publicly-funded projects from the EU, China and the UK coming in between 2035 and 2050. The reality is there will be a long lag between “net gain” and commercial electricity supply despite the huge demand. Even if net gain was achieved tomorrow, it will still take the best part of a decade to make a material impact on grid supply. For our purposes we do not need to distinguish between 2030 or 2040. We can put nuclear fusion on the 2030+ timeframe making it hard to see a pathway for VC funding.”

I’ll still out here calling shots.

To be clear, I was bullish on fusion generally, but specifically I thought the 15 year timeline for a electricity producing facility was sad for VCs. Especially for early-stage VCs.

It holds up well, despite recent funding by Pacific Fusion and Proxima Fusion and net gain at LLNL a few years ago. But I read somewhere that the top decile performers change their mind three times a year? So let’s see, am I a top decile performer?

My earlier assessment relied on two main assumptions:

The "first wall problem": Protecting the reactor from neutron damage is unsolved and, even if solved, would likely require a separate testing facility, which itself would take at least five years to build.

Cost: ITER’s estimated cost is $20–25 billion per GW, with private companies targeting $2–5 billion for 100–500 MW plants and Levelized Costs of Energy (LCOE) of $50–100/MWh. These costs would compete with advanced SMRs at $60–100/MWh (likely trending lower), gas with carbon capture at $70–120/MWh, and wind-plus-storage at $40–80/MWh.

So in theory, if we could find a way to solve the first wall problem and reduce costs, maybe we could speed up deployment time?

The big hope with my so-called research is to build epistemic infrastructure enabling unusual connections between disparate technologies to uncover novel investment opportunities. What’s striking, is how similar the analysis of market dynamics is for SMRs, quantum and fusion. There is no “ground truth”. Just the same trade-offs with proponents arguing that their particular trade-off will win. I will never interview someone who will give me the “truth”. I’ll just find different scientists making different trade-offs.

Scientist 1: “Getting to market first is most important because of path dependency."

Scientist 2: “No, we need a scalable system to win long-term”

Scientist 3: “No, the only thing that matters is cost for adoption, we need to focus on lower capex and opex to win long-term”

Choose your player…

Multiple Technical Approaches:

Fusion: Tokamaks, stellarators, magnetic mirrors, z-pinch, inertial, magnetized target

SMRs: Light water, molten salt, high temperature gas, liquid metal, microreactors

Quantum: Superconducting, ion trap, photonic, neutral atom, topological, silicon spin

Trade-offs:

Performance vs Complexity

Time to Market vs Ultimate Potential

Operating Costs vs Capital Costs

Scalability vs Initial Capability

Material Requirements vs Technical Maturity

Market Dynamics:

Early leaders might not be long-term winners (short and long term bets)

Different approaches might serve different market niches (no ring to rule them all)

Supply chain and manufacturing capabilities matter as much as core technology (manufacturing not science risk)

The key insight is that, like in quantum computing, we might see different fusion/SMR approaches winning in different timeframes:

Short/medium term (2025-2035):

SMRs: Light water designs like NuScale and BWRX-300, leveraging decades of PWR/BWR experience

Fusion: Simpler magnetic configurations like Helion's field-reversed configuration or Commonwealth's compact tokamak, which prioritize speed to market over ultimate performance

Quantum: Superconducting qubits and trapped ions, which are more mature but face scaling challenges

Medium/long-term (2035-2045):

SMRs:

Molten salt and high-temperature gas reactors like Terrestrial's IMSR or X-energy's Xe-100, offering improved efficiency and safety features

Advanced designs like liquid metal fast reactors and hybrid fusion-fission systems

Fusion:

More sophisticated magnetically confined approaches like TAE's beam-driven FRC or General Fusion's magnetized target fusion

Stellarators like Wendelstein 7-X and advanced tokamaks with high-temperature superconductors

Quantum:

Silicon spin qubits and neutral atoms, balancing scalability with coherence times

Topological qubits and photonic systems, which are theoretically superior but require significant technological advancement

Here is your TLDR

While deuterium-tritium (DT) fusion in tokamaks faces severe first wall challenges from intense neutron bombardment, alternative approaches offer promising solutions. Deuterium-deuterium (DD) fusion produces much lower-energy neutrons (2.45 MeV vs 14.1 MeV), reducing material damage and eliminating the expensive tritium fuel cycle.

Alternative confinement methods also show promise for cost reduction. Laser inertial confinement fusion (ICF) simplifies the first wall problem through brief pulse operation, while pulsed-power systems like the Z-machine use simpler, replaceable components instead of complex superconducting magnets. Though these approaches face their own challenges in target production and debris management, they may offer a more practical path to fusion with lower infrastructure costs.

While alternative approaches like DD fuel and pulsed systems offer promising paths to reduce costs and engineering complexity, commercial fusion before 2035 remains unlikely. I’m increasing the probability from 5% to 15%, but significant technical and economic hurdles suggest deployment is more realistic in the 2040+ timeframe. The biggest opportunities imo are AI for Plasma Control Systems, Digital Twin/Simulation Software, and Advanced Materials and Component Manufacturing especially for Rare-earth barium copper oxide (ReBCO) tape manufacturing, first wall materials, and ICF target cost reductions.

Summary

Nuclear fusion combines light atomic nuclei to form heavier ones, releasing massive energy - the same process powering the Sun. Success requires meeting the "triple product": specific temperature, density, and confinement time conditions. The temperature requirement alone is extraordinary at 100 million degrees Celsius, far hotter than the Sun's core. At such temperatures, matter becomes plasma.

The big challenge is containing this superheated plasma long enough for fusion. While magnetic fields can confine it, the plasma is inherently unstable. Even minor instabilities can cause plasma contact with reactor walls, disrupting the reaction. No materials can directly withstand fusion conditions, and neutron bombardment steadily degrades reactor components.

Until recently, fusion experiments consumed more energy than they produced. While breakthroughs like the National Ignition Facility's 2022 net energy gain show progress, converting fusion energy to usable electricity remains challenging. The process demands precise systems for fuel handling, cooling, and power extraction.

To grossly oversimplify, there are three main approaches:

Magnetic confinement: Uses powerful magnets to contain plasma - theoretically effective but mechanically complex. Known as MCF.

Inertial confinement: Uses lasers to compress fuel - simpler concept limited by laser technology. Known as ICF.

Field-reversed method: Creates self-contained plasma rings - more compact design but less proven technology. Known as FRC.

Magnetic Confinement Fusion (MCF)

The first and most advanced approach is magnetic confinement fusion (MCF). This method uses magnetic fields to contain and heat plasma to fusion temperatures exceeding 100 million degrees Celsus. The magnetic fields create an invisible "bottle" that keeps the hot plasma away from material walls, allowing for sustained fusion reactions.

MCF comes in two flavours, tokamak and stellarator.

The dominant MCF design is the tokamak, a donut-shaped vessel surrounded by powerful magnetic coils. These devices use a combination of toroidal (around the donut) and poloidal (vertical) magnetic fields to contain the plasma. This is by far the most mature design.

The alternative is the stellarator, which uses a more complex twisted magnetic chamber design. While stellarators offer better stability, their intricate geometry makes them significantly more challenging to construct.

Both designs, faces three major technical hurdles: plasma stability, the first wall problem, and superconducting magnets.

First, plasma stability. It’s very hard to keep the plasma stable. The magnetically-confined plasma frequently experiences severe instabilities that can rapidly release enormous amounts of energy. Major disruptions can discharge the entire plasma energy within milliseconds, while routine edge instabilities expel significant portions of stored energy as intense heat loads onto reactor surfaces. Internal plasma disturbances create magnetic irregularities that substantially degrade fusion performance, and oscillations in the plasma core further compromise stable operation.

Second, the aforementioned, the first wall problem. The reactor's first wall experiences intense neutron bombardment at 14.1 MeV (mega-electron volts), causing significant atomic displacement damage within the material structure. To put this in perspective, a dental X-ray delivers about 0.001 MeV, and even the high-energy gamma rays from nuclear fission are typically around 1-2 MeV. The divertor components must withstand extreme steady-state heat loads while managing intermittent power spikes that exceed normal operating conditions. Tungsten-based materials, despite their superior thermal properties, operate at their absolute limits and experience substantial erosion under these conditions. This degradation necessitates frequent component replacement, significantly impacting reactor availability and economic viability.

Third, magnets, MCF needs very powerful superconducting magnets. These systems must generate extremely powerful magnetic fields of 12-20 tesla to adequately confine the plasma. Again, for context, the most powerful MRI machines ever built for medical research reach only 7 tesla. The required REBCO (Rare Earth Barium Copper Oxide) is a type of high-temperature superconductor material, while offering superior performance, incur substantial costs and face manufacturing constraints that limit reactor construction. The cryogenic cooling requirements for these magnet systems, whether utilizing traditional or high-temperature superconductors, impose a meaningful parasitic load on the plant's power output, impacting overall system efficiency.

Why It Will Win:

Most mature and proven plasma physics of any approach

Strongest scientific consensus behind its feasibility

Clear pathway to steady-state operation

Why It Won't Win:

Materials challenges may prove insurmountable at scale

Enormous size and cost requirements ($5-10B+ per plant)

Extremely complex engineering with tight tolerances

Projects

MCF (Tokamak): ITER (France/International), Commonwealth Fusion Systems (CFS) (US), Tokamak Energy (UK, Princeton Fusion System (US)

MCF (Stellarator): Proxima Fusion (Germany), LHD (Japan), Hybrids: Type One Energy (US), Renaissance Fusion (France)

Inertial Confinement Fusion (ICF)

Inertial Confinement Fusion (ICF) differs fundamentally from magnetic confinement methods. Rather than attempting to maintain a stable plasma state for extended periods, ICF focuses on creating extremely brief but intense fusion reactions through rapid compression of miniature fuel targets. The process relies on the principle of inertial confinement: the fuel's own mass provides sufficient inertia to maintain compression long enough for fusion reactions to occur, typically on the order of nanoseconds.

Laser ICF

Laser-driven ICF used at the National Ignition Facility (NIF) employs multiple high-energy laser beams to precisely strike a hohlraum containing a fusion target. The laser energy converts to X-rays within the hohlraum, creating a uniform radiation bath that drives the implosion of a millimeter-scale fuel capsule. A variant of this approach, pursued by Marvel Fusion, utilizes ultra-short pulse lasers operating in the picosecond or femtosecond regime. This "fast ignition" technique aims to achieve fusion through direct laser-fuel interaction rather than X-ray driven compression, potentially offering improved energy coupling efficiency.

In 2023, the National Ignition Facility (NIF) achieved a historic milestone by demonstrating net energy gain from a fusion reaction, producing 3.15 MJ of energy from 2.05 MJ of laser input. You might think, great let’s build! You would be wrong. The facility requires approximately 400 MJ of electricity to power its lasers, a the significant gap between experimental net energy gain and practical energy efficiency for commercial viability. Plus, NIF can only fire a few shots per day due to cooling and recovery requirements, while a commercial reactor would need 10-15 shots per second. The facility's massive scale, complex infrastructure (192 laser beams), and expensive target manufacturing (currently thousands of dollars per target versus the needed sub-dollar cost) present significant challenges for commercial viability.

Laser ICF faces more technical hurdles. Laser-plasma instabilities, particularly stimulated Raman and Brillouin scattering, can disrupt the symmetry of compression. The intense laser pulses, typically delivering megajoules of energy, gradually damage optical components through processes like optical coating ablation and bulk material damage, limiting both shot frequency and system lifetime. The overall wall-plug efficiency remains problematic, with current systems converting only about 1% of input electricity to useful compression energy. Additionally, achieving precise synchronization across hundreds of laser beams to within picoseconds presents ongoing engineering challenges.

Why Laser ICF Will Win:

Only approach to demonstrate net energy gain from fusion

Leverages rapid advances in industrial laser technology

Benefits from massive existing research infrastructure and expertise

Why Laser ICF Won't Win:

Fundamental wall-plug efficiency barrier (~1% currently to needed ~10-20%)

Complex target manufacturing costs ($1000s/target to needed sub-$1)

Requires breakthroughs in multiple areas (optics, repetition rate, materials) simultaneously

Projects

NIF (US), First Light Fusion (UK), Marvel Fusion (US)

Pulsed-power ICF

This approach used by facilities like Sandia's Z-machine uses electrical currents—up to 27 million amperes—to generate powerful magnetic fields that compress a fusion target. A typical lightning bolt is around 30,000 amperes (0.03 MA), so the Z-machine creates electrical currents nearly 1,000 times stronger than lightning. When triggered, stored electrical energy rapidly discharges through the target, creating magnetic pressures exceeding 10 million atmospheres. A variant of this approach, being explored at other facilities, uses different target geometries and current paths to achieve compression, potentially offering better energy coupling efficiency.

The Z-machine has achieved significant results in plasma physics research, but faces challenges for power generation. While it can generate extremely high pressures and temperatures, the facility requires extensive maintenance between shots due to the violence of each discharge. The machine literally tears itself apart with each shot, vaporizing components and requiring regular replacement of key parts. Plus, the facility can only fire once or twice per day, while a commercial reactor would need multiple shots per second.

But with pulse-power, the enormous electromagnetic forces cause severe electrode erosion and structural damage with each shot. The magnetic field configuration creates inherent asymmetries that make uniform compression difficult to achieve. Managing and containing the debris from vaporized components presents ongoing challenges. Additionally, the basic physics of magnetic field penetration and current flow through plasmas creates fundamental limits on how quickly the target can be compressed.

Why Pulsed-power ICF Will Win:

Simpler and potentially cheaper than laser systems

Higher inherent energy efficiency (~15% wall-plug)

More robust/replaceable components than precision optics

Why Pulsed-power ICF Won't Win:

Fundamental limits on magnetic field penetration rates

Severe electrode erosion/damage with each shot

Challenging to achieve required symmetric compression

Projects

ZAP Energy (US), Sandia National Laboratories Z-machine (US)

Projectile-based ICF

The third and most recent approach is projectile-driven ICF used by First Light Fusion and General Fusion. This approach uses hypervelocity projectiles—fired at speeds exceeding 6.5 kilometers per second—to create extreme compression through direct impact with specially designed targets. For context, a high-powered rifle bullet travels at ~1 km/s. When the projectile hits, the impact generates pressures in the millions of atmospheres, potentially sufficient for fusion. A variant of this approach involves different projectile and target geometries designed to better focus and amplify the impact forces, possibly offering more efficient energy coupling.

While newer to the fusion race, projectile ICF offers intriguing advantages for power generation. The mechanical systems are relatively simple compared to lasers or pulsed power, potentially lowering capital costs significantly. However, the approach faces similar repetition rate challenges to other ICF methods - currently achieving only a few shots per day while commercial viability requires multiple shots per second. Plus, each shot destroys both projectile and target, requiring continuous replenishment of components.

Projectile ICF faces unique technical hurdles. Achieving the necessary impact velocities while maintaining precise projectile alignment presents significant engineering challenges. The extreme mechanical stresses on the launcher system limit lifetime and reliability. Managing the debris from impacts, which essentially vaporize both projectile and target, requires sophisticated containment and clearing systems. Additionally, the basic physics of impact-driven compression may limit how effectively energy can couple into the fusion fuel.

Why Projectile ICF Will Win:

Mechanically simpler than other ICF approaches

Potentially lower capital and operating costs

More straightforward engineering scaling path

Why Projectile ICF Won't Win:

Has yet to demonstrate fusion conditions

Fundamental velocity limits with current materials

Challenging debris management at commercial repetition rates

Projects

First Light Fusion (UK), HyperJet Fusion (US), General Fusion (Canada)

Field-Reversed Configuration (FRC)

The Field-Reversed Configuration represents a unique hybrid approach to fusion. FRCs create a self-contained plasma ring without requiring a central penetration through the plasma, unlike tokamaks. This results in a compact toroidal plasma shape where the magnetic field lines form closed loops without needing a central magnet structure. These aren't distinct categories of FRC variants, but rather different approaches companies are taking to implement and improve FRC technology.

TAE Technologies uses particle beams for heating and aims to use advanced fuels like proton-boron. Zap Energy employs a flowing plasma with magnetic self-confinement. Helion Energy combines magnetic and inertial approaches using colliding FRCs for compression.

FRCs offer several potential advantages: simpler geometry than tokamaks, better theoretical power density, natural stability in certain conditions, and potentially simpler engineering requirements. FRC fusion faces challenges centered on plasma physics fundamentals. The primary issue lies in plasma stability scaling—as FRCs grow larger, they become increasingly susceptible to tilt and rotational instabilities. These modes can destroy plasma confinement in microseconds, limiting achievable plasma size and energy containment.

Confinement time presents an equally critical challenge. Current FRC devices maintain plasma for only hundreds of microseconds, far short of the milliseconds required for net energy production. This brief confinement stems from rapid particle and energy losses through the device's open magnetic field lines at the ends of the configuration. While companies like TAE Technologies have achieved some stability improvements through plasma rotation and beam injection, extending confinement time remains a fundamental hurdle.

Heat and particle transport across magnetic field lines occurs faster than classical theory predicts, leading to poor energy confinement. This anomalous transport, coupled with the inherent challenges of the open-field geometry, makes achieving fusion-relevant parameters particularly demanding with FRC, despite its engineering simplicity and cost advantages.

Why It Will Win:

Potentially smaller and cheaper than other approaches

Natural divertor reduces heat management issues

Better power density than tokamaks

Why It Won't Win:

Least proven physics of major approaches

Stability challenges may prove fundamental

Requires advances in plasma control

Projects

Helion Energy, TAE Technologies, Zap Energy

Fuels

Fusion fuel selection critically impacts reactor design, operational challenges, and commercial viability. The choice of fuel determines temperature requirements, neutron production, fuel availability, and power generation methods.

DT (Deuterium-Tritium) Currently the most promising approach, requiring lowest temperatures (~100M °C) with highest reaction rates and well-understood physics. Deuterium is abundant in seawater, but tritium must be bred from lithium using neutrons from the fusion reaction. Main challenges include expensive tritium ($30,000/gram), high-energy neutron damage (14.1 MeV) requiring sophisticated shielding and remote handling, and complex breeding systems. Despite these issues, it remains the primary focus due to lower technical barriers.

DD (Deuterium-Deuterium) Uses abundant deuterium from seawater, producing two different reactions: helium-3/neutron or tritium/proton. While requiring higher temperatures (~400M °C), it causes less material damage with lower-energy neutrons (2.45 MeV) and eliminates expensive tritium breeding. The fuel could power civilization for billions of years, but lower power density and higher temperature requirements make ignition more challenging than DT.

D3He (Deuterium-Helium-3) A middle-ground approach producing fewer neutrons and enabling direct electricity conversion through charged particles. Requires ~600M °C and faces helium-3 scarcity on Earth, though it exists abundantly on the Moon. While promising for space applications due to high energy density and reduced neutron production, practical implementation depends on solving fuel availability through lunar mining.

P11B (Proton-Boron-11) Revolutionary aneutronic approach producing minimal neutrons and enabling direct electricity conversion through alpha particles. Uses abundant terrestrial materials and requires minimal shielding, but demands extreme temperatures (~3B °C) and has very low power density. Pursued by companies like TAE Technologies for its potential for simpler reactor designs and minimal radioactive waste, despite formidable technical challenges in achieving required conditions.

Each fuel type presents distinct trade-offs between temperature requirements, material damage, fuel availability, and power generation efficiency, forcing fusion developers to balance near-term achievability against long-term commercial potential.

Market Size

The nuclear fusion market remains pre-commercial, with no direct market size. But it’s fusion right. It’s very much, if you build it they will come.

Private investment in fusion technology reached $5 billion in 2023. While some projections suggest a potential market size of $40 billion by 2030, this figure primarily represents investment rather than revenue, as commercial operations are unlikely to be widespread by that date. Fwiw, the nuclear power market is valued at approximately $350 billion as of 2023, with projected growth of 8% through 2030. Although this is a severe underestimate imo (see Small modular reactors (SMRs).

Key Players

Market Drivers

Policy and Market Mechanisms

The global carbon pricing landscape has evolved substantially, with the EU ETS reaching €100/tonne in 2023 and similar mechanisms emerging in China, covering 40% of global emissions. Specific fusion-relevant policies include the UK's £650M fusion strategy and the US CHIPS and Science Act allocating $4.7B to fusion research through 2027. Quantitative analyses from the IPCC AR6 and IEA Net Zero reports indicate a 400-800 GW clean firm power gap by 2050 that cannot be cost-effectively filled by renewables and storage at current learning rates (13% for solar, 16% for batteries). MIT's "The Future of Energy Storage" (2022) demonstrates that beyond 85% grid penetration, renewable integration costs increase exponentially, creating a compelling economic case for fusion's baseload capabilities. The Canadian Net-Zero Emissions Accountability Act and Japan's Green Transformation (GX) plan have specifically included fusion in their long-term energy strategies, representing a shift from previous policy frameworks focused solely on renewables and fission.

Plasma Control with ML

DeepMind's 2022 paper "Magnetic Control of Tokamak Plasmas through Deep Reinforcement Learning" demonstrated real-time optimization of plasma stability, achieving a 25% improvement in confinement time and 50% reduction in disruptions compared to traditional control systems. This builds on earlier work at DIII-D using the Plasma Control System (PCS), which achieved the first fully autonomous plasma control in 2020. In materials science, the development of REBCO tapes with engineering current densities exceeding 1000 A/mm² at 20K (demonstrated by Commonwealth Fusion Systems) represents a 3x improvement over previous superconductor performance. The convergence extends to computational capabilities, with Aurora at Argonne National Laboratory achieving exascale fusion plasma simulation in 2023, enabling first-principles modeling of alpha particle physics and turbulent transport. Notably, Microsoft's quantum computing division has partnered with ITER to develop quantum algorithms for plasma optimization, while Google's TPU v4 systems are being applied to real-time magnetic field optimization at KSTAR.

Private Investment

Total private fusion investment has reached $6.2B by Q1 2024, with $4.8B deployed since 2021 alone. Big rounds include Commonwealth Fusion Systems ($1.8B Series B led by Tiger Global), Helion Energy ($2.2B including $375M from Sam Altman), and TAE Technologies ($1.2B including strategic investment from Google). Strategic corporate investors now include Chevron Technology Ventures (invested in Zap Energy), Equinor Ventures (General Fusion), and SK Innovation (Commonwealth Fusion). Investment patterns show increasing specialization, with Microsoft's quantum computing partnership valued at $50M and Siemens' Digital Industries providing advanced control systems to multiple fusion startups. The investor landscape has evolved to include institutional players like NEA, Khosla Ventures, and Breakthrough Energy Ventures. Notably, sovereign wealth funds have entered the space, with Saudi Aramco's investment arm leading a $200M round in Tokamak Energy and Singapore's Temasek participating in First Light Fusion's Series B. The establishment of dedicated fusion investment vehicles, such as Strong Atomics ($100M fusion-focused fund) and the UK's Fusion Industry Association's £200M matching fund, indicates the maturation of fusion as an investment category. Investment is now segmented across technology approaches:

Tokamak designs: $4.1B (66% of total investment)

Alternative magnetic confinement: $1.2B (19%)

Inertial confinement: $500M (8%)

Supporting technologies: $400M (7%)

Market Restraints

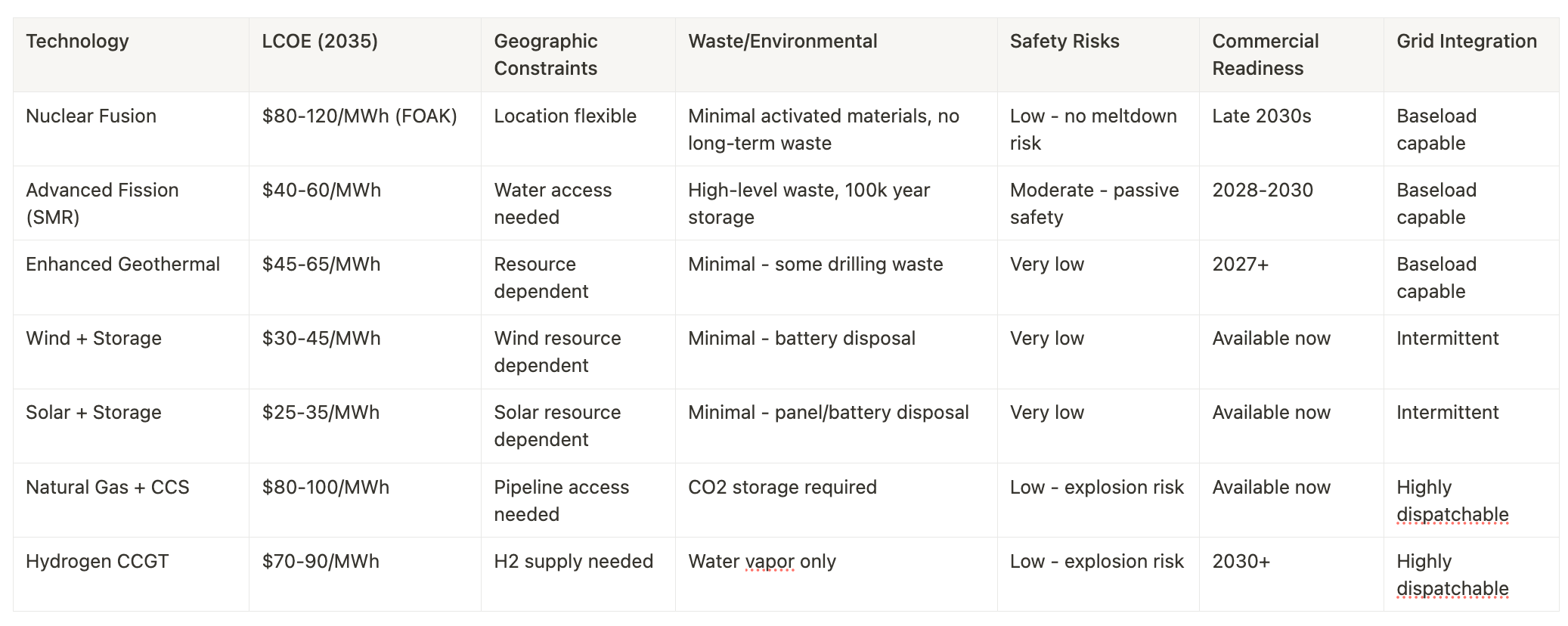

Cost Competitiveness in 2030s Energy Markets

The projected Levelized Cost of Energy (LCOE) for first-generation commercial fusion plants in the 2030s faces significant headwinds against rapidly declining costs of alternative energy sources. Current fusion LCOE projections for first commercial plants are expected to be significantly higher than the previously estimated $60-100/MWh for nth-of-a-kind plants. Early commercial plants may see LCOE in the range of $150-200/MWh, with cost reductions dependent on successful technological development and learning rates similar to fission deployment.

Meanwhile, Bloomberg NEF's latest projections show utility-scale solar-plus-storage LCOE declining to $35-45/MWh by 2030 in optimal locations, with wind-plus-storage reaching $40-50/MWh. This represents a continuation of historical learning rates: solar costs have declined 90% since 2010, while battery storage costs have fallen 89%. Even accounting for grid integration costs at high renewable penetration, McKinsey's analysis suggests total system costs for 100% renewable grids could reach $70-90/MWh by 2035, including necessary transmission upgrades and long-duration storage.

Advanced fission designs, particularly Small modular reactors (SMRs) are projected to achieve LCOEs of $40-60/MWh, with the advantage of proven technology and existing regulatory frameworks. Natural gas with carbon capture and storage (CCS) is expected to operate at $70-90/MWh assuming carbon prices of $100/tonne, providing another competing baseload option.

Market Entry Timing Challenges

Fusion's projected market entry in the 2030s coincides with several challenging market dynamics. By 2035, the International Energy Agency projects global renewable energy capacity will triple to 11,000 GW, with significant investments in grid infrastructure and storage already locked in. This creates potential stranded asset risk for utilities considering fusion investments. Major markets including California, Germany, and Australia will have substantially completed their grid transformation programs, potentially limiting greenfield opportunities for new baseload capacity.

The timing challenge extends to financing structures. Project finance mechanisms for renewable energy are well-established, with typical debt/equity ratios of 80/20 and costs of capital below 5% in developed markets. In contrast, first-generation fusion plants will likely require much higher equity components (estimated 40-50%) and higher returns to compensate for technology risk, significantly impacting their competitive position. Infrastructure funds and green bonds, which have become major funding sources for clean energy deployment, typically require proven technology track records spanning multiple years.

Capital Allocation Competition

The scale of capital required for commercial fusion deployment faces intense competition from established clean energy technologies. A single 1 GW fusion plant is estimated to cost $5-10 billion, while the same capital could fund approximately 3-4 GW of solar-plus-storage capacity based on 2030 projected costs. This comparison becomes more challenging when considering the portfolio effect: utilities and investors can deploy renewable projects incrementally, better matching demand growth and reducing risk exposure.

Major energy companies' capital allocation strategies increasingly focus on near-term decarbonization opportunities. ExxonMobil's $20 billion investment in carbon capture and hydrogen, Shell's annual $2-3 billion renewable energy investment program, and BP's target of 50 GW renewable capacity by 2030 indicate strong competition for clean energy investment capital. The total announced clean energy investment pipeline for major utilities and energy companies exceeds $1 trillion through 2030, with less than 1% currently allocated to fusion development.

Investment metrics favor proven technologies: the weighted average cost of capital (WACC) for utility-scale solar projects in major markets has fallen to 3-4%, while emerging technologies typically require returns of 15-20% to compensate for technology risk. This differential creates a significant hurdle for fusion projects, particularly given the scale of capital required and the long lead times to first revenue. Morgan Stanley's analysis suggests fusion projects would need to demonstrate potential returns of 25-30% to attract significant private capital given current risk profiles, requiring either substantially higher electricity prices or significant government support mechanisms.

Differentiation

Fusion's competitive advantages center on its environmental, operational, and security characteristics. It produces no long-term radioactive waste or carbon emissions, with activated materials remaining radioactive for decades rather than millennia. Unlike geothermal, wind, or solar installations, fusion plants can operate continuously at any grid-connected location with minimal water requirements. The fuel cycle uses abundant deuterium from seawater and lithium, avoiding uranium enrichment challenges and rare earth material dependencies. Safety represents another key advantage, as plasma containment physics ensures any failure immediately halts the fusion reaction, eliminating meltdown risks associated with fission or explosive potential of hydrogen storage.

It’s the holy grail of energy, basically.

However, money as always. First of a kind (FOAK) LCOE projected at $80-120/MWh, substantially higher than mature renewable systems ($25-45/MWh with storage) and advanced fission ($40-60/MWh). And solar, wind and batteries continue to overshoot projects on cost declines so I wouldn’t be surprised if the target LCOE has to be even lower for 2nd/3rd gen reactors. But think of the sequencing here. As fusion enters commercial use after widespread renewable deployment, it will face an electricity grid potentially optimized for distributed generation. Success depends on aggressive cost reduction, higher-than-expected renewable integration costs, strong carbon pricing, and policy recognition of fusion's unique benefits.

While fusion may not compete purely on cost in 2035, its combination of environmental, safety, and security characteristics could justify its role in regions prioritizing energy independence and zero-emission baseload capacity, provided it maintains investment and policy support through commercialization.

The Bull Case for Fusion Economics

Cost curves

Cost reduction dynamics in fusion technology are proving dramatically steeper than mature renewable technologies. While solar and wind typically achieve 15-20% cost reductions per doubling of production, key fusion components like high-temperature superconductors demonstrate up to 45% cost reduction per doubling. This accelerated learning curve stems from fusion's digital-first development approach and the integration of advanced manufacturing techniques. The emergence of standardized, modular designs and AI-optimized production processes suggests potential for even faster cost improvements than we witnessed in solar's remarkable evolution.

Learning curve

The historical pattern of clean energy cost reduction offers particularly compelling evidence for fusion's near-term potential. Solar's transformative 85% cost reduction occurred over 15 years, but the majority of these gains materialized in the first 5-7 years of commercial deployment. Fusion technology, benefiting from sophisticated simulation capabilities and machine learning optimization, is positioned to compress this learning curve even further. The cross-pollination of innovation from adjacent industries like semiconductors and aerospace accelerates this trajectory, while digital twin technology and advanced materials science drive unprecedented speed in design iteration and validation.

System value

System value considerations strengthen fusion's economic proposition beyond pure cost metrics. Major utilities' modeling indicates that by 2040, with renewable penetration exceeding 80%, grid balancing costs could add $30-50/MWh to the effective cost of intermittent energy sources. In this context, fusion's projected $80/MWh levelized cost becomes highly competitive when accounting for its unique advantages: zero intermittency, flexible siting near demand centers, minimal transmission requirements, and valuable grid stability services worth an additional $15-25/MWh. The environmental premium – zero carbon emissions, minimal land use, and absence of long-term waste management costs – adds another $20-30/MWh in value within carbon-priced markets.

Geopolitical value

The geopolitical dimension adds another layer of compelling value. Major energy companies increasingly view fusion investment through the lens of energy security and strategic autonomy. This strategic imperative, combined with growing government support for clean energy independence, suggests strong policy tailwinds for fusion's commercial deployment. Early government support for demonstration plants, similar to the catalytic role played in solar and wind deployment, could accelerate cost reduction through the critical early commercial phase.

Market size

The sheer scale of the addressable market provides the final pillar of the investment thesis. The projected $20 trillion clean energy market by 2050 means that even modest market penetration of 5-10% would represent transformative value creation. While fusion's initial costs present clear challenges, the combination of accelerated learning rates, substantial system value premium, and strategic importance creates compelling potential for faster-than-expected cost reduction post-2035.

Opportunities

AI for Plasma Control Systems

DeepMind demonstrated 25% improvement in plasma confinement time and 50% reduction in disruptions versus traditional controls. This represents an ideal early-stage venture opportunity: low capital requirements, potential pre-fusion revenue, and value across multiple approaches (tokamak, stellarator, FRC). The AI-fusion intersection enables building software and services for both research institutions and commercial developers.

Digital Twin/Simulation Software

Fusion development increasingly relies on advanced simulation, evidenced by Aurora exascale computing and Microsoft's ITER partnership. A digital twin startup could accelerate development across multiple fusion approaches with lower capital requirements than hardware plays. The opportunity is compelling as it addresses critical physics challenges while generating revenue through licensing to developers and research institutions.

Advanced Materials and Component Manufacturing

Critical materials challenges include ReBCO tape manufacturing (3x improvements demonstrated) and first wall materials for neutron bombardment. ICF approaches need target costs reduced from thousands to sub-dollar levels. These fundamental bottlenecks represent opportunities valuable across the industry. Manufacturing focus enables early revenue through research facility sales and industrial applications.

If you got to the end, you’ve got serious value out of me and Lunar. The least you can do is hit the share button.